Automatically build your savings with every

Visa® debit card purchase you make.

With ROUND UP savings, every purchase you make with your Interstate Credit Union Visa® debit card is rounded up to the nearest dollar. The round-up cents are then deposited into one of your eligible saving accounts. Now every time you spend, you also save a little – and over time this can add up to a lot!

How It Works

It’s easy! Every debit card transaction posted to your checking account is rounded up to the nearest dollar, and the difference in cents is automatically transferred to your savings account.

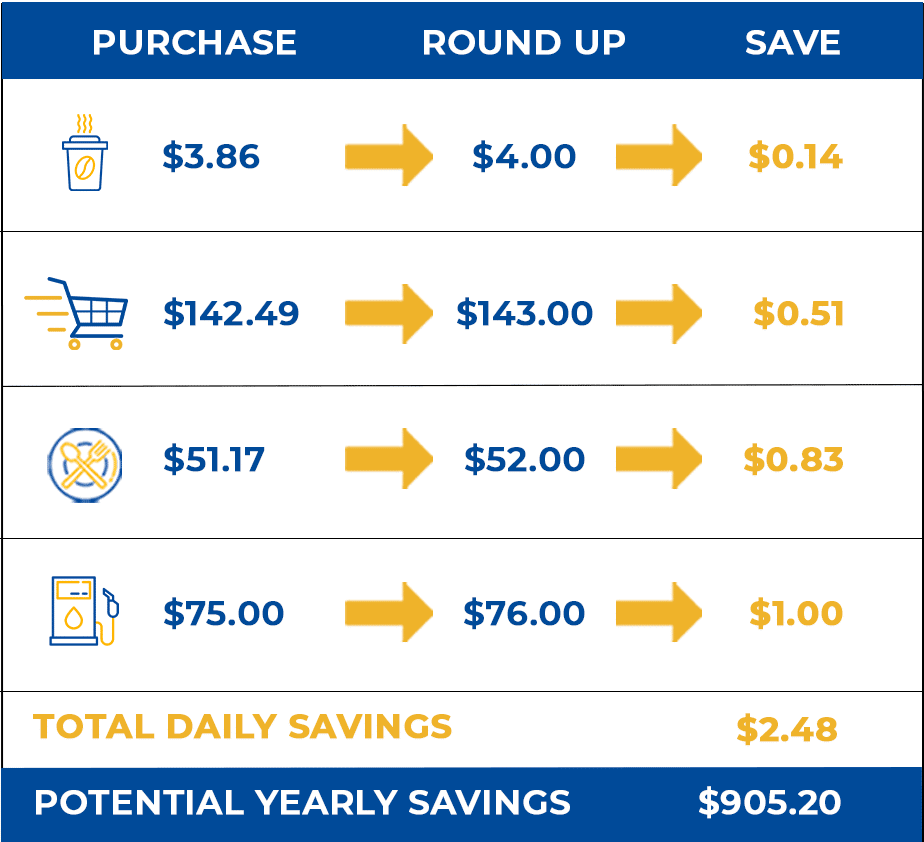

Here is an example:

- You buy your morning coffee for $3.86 (round up $.14)

- You buy groceries for $142.49 (round up $.51)

- You go out to dinner and spend $51.17 (round up $.83)

- You buy gas for $75.00 (round up $1.00)

ROUND UP TOTAL = $2.48

In this example, if these four transactions are processed and posted to your account on the same day, $2.48 will be transferred from your checking account to your designated savings account.*

The amount of the debits will not be processed on the account if the amount will cause an overdraft to the checking account nor trigger an Overdraft Protection transfer if your account is set up to do so. Transactions made at a whole dollar amount will round up one dollar. ATM transactions will not be rounded up. Only checking accounts with active debit cards are eligible to be enrolled in ROUND UP Savings. For additional information, please refer to our FAQs.

*Example is for illustrative purposes only. Not all vendors process same day transactions, so round up transactions may vary based on timing of vendor processing. Some restrictions may apply. Actual savings will vary based on debit card use. Deposits may not be made to IRA or Escrow accounts. The transactions will appear on your statement as “ROUND UP TRANSFER”.

You may enroll by completing the ROUND UP form. You may also enroll by visiting a local branch during normal business hours (see locations).

By authorizing enrollment into ROUND UP Savings, you acknowledge the following terms and conditions:

- ROUND UP savings transfers only apply to debit card purchases on the debit card you enroll.

- Certain debit card transaction types may be excluded from ROUND UP savings.

- If your debit card purchase is subsequently canceled or reversed, the corresponding ROUND UP savings transfer remains in the account it was transferred to.

- Funds will be transferred only to an active Interstate Credit Union savings account.

- If you have a change in account ownership, including being removed from the account your ROUND UP savings transfers are being deposited into, or need to change the transfer you’ve set up, you are responsible for contacting Interstate Credit Union to implement the change.

- If the checking account enrolled in ROUND UP savings is closed or the savings account receiving ROUND UP savings transfers is closed, your ROUND UP savings enrollment will be canceled.

- Interstate Credit Union shall not be liable for any loss, expenses, costs, or reasonable attorney fees resulting from a transfer which is not carried out. You will not hold us responsible for and you agree to reimburse us for losses, expenses, costs, or reasonable attorney fees resulting from not carrying out a transfer under such circumstances.

ROUND UP savings is a transfer program designed to help Interstate Credit Union members add money to a savings account. ROUND UP savings rounds up each debit card transaction to the next whole dollar each time you make a debit card purchase. These rounded up cents are debited from your checking account and credited to your selected savings account.

To explain in more detail, each business day, the debit card transactions that post and clear to your checking account are rounded up to the nearest whole dollar. The amount of the ROUND UP cents will be the amount debited from your checking account and posted to your designated savings account on the same business day.

Transactions

Debit card transactions are rounded up and counted toward the transfer once they post and clear the account (transactions in pending status are not). If there are multiple debit cards associated with your checking account with ROUND UP savings, debit transactions will be rounded up for only the debit card(s) enrolled. ROUND UP savings will cease if your debit card is replaced, including if you get a different debit card number. The new debit card number will need to be enrolled.

Account Available Balance Cancellation

The daily transfer will not occur if the amount of the debit exceeds the available balance in your checking account. ROUND UP savings transfers will not incur overdraft fees, nor prompt overdraft protection transfers. Any transfers that do not post due to an insufficient available balance in your checking account should be considered cancelled and will not be debited from your account at a later time. As a user of ROUND UP savings, you are responsible for calculating and accounting for the amount of the daily debits set to transfer out of your checking account as agreed by you by signing the ROUND UP savings Enrollment Form. The daily transfer of debits will reduce the balance in your checking account available to use for other transactions.

Other Limitations that may Cause Cancellation

Both the checking and the savings account must be active (not in a dormant or inactive status) for the daily transfer to occur.

Excluded Transactions

ATM transactions will not be rounded up.

Eligibility

You must have and maintain at least one active consumer checking account with at least one active debit card associated to the checking account. Additionally, you must designate an active consumer savings account to receive the ROUND UP transfer. You may not designate an IRA or Escrow account for the ROUND UP savings program.

Request to Terminate

You may terminate this transfer agreement at any time by visiting a local branch or calling us toll-free during normal business hours at 800-822-1124. If you decide to terminate your daily transfer today, any pending transactions may still be processed as ROUND UP transactions.

Is there a service charge or fee for ROUND UP Savings?

No. There are no service charges or fees to be enrolled in the ROUND UP savings program.

Can I use any debit card for this program?

Only Interstate Credit Union Visa® debit cards linked to an Interstate Credit Union checking account are eligible for the ROUND UP savings program.

Which savings account can receive my rounded up deposits?

During enrollment, you can designate your deposits to be made to your Regular Share Savings, Money Market, Vacation Club, or Christmas Club accounts. Deposits can not be made to IRA or Escrow accounts.

If I have multiple Interstate Credit Union checking accounts, can I sign up for ROUND UP savings for all of my checking accounts?

Yes. You may sign up all of your consumer Interstate Credit Union checking accounts for this program that have a debit card linked to each checking account.

Do ROUND UP savings transfers apply to checks written on my account?

No, your checks will not be rounded up. ROUND UP savings only applies to debit card purchases on the account you enroll.

What if I don’t have enough funds in my checking account to cover the rounded up amount for transfer?

The daily transfer will not occur if the amount of the debit exceeds the available balance in your checking account. ROUND UP savings transfers will not incur overdraft fees, nor prompt overdraft protection transfers. Any transfers that do not post due to an insufficient available balance in your checking account should be considered cancelled and will not be debited from your account at a later time.

My spouse and I have a joint checking account with individual debit cards. Will ROUND UP savings apply to both cards?

No. If there are multiple debit cards associated with your checking account with ROUND UP savings, debit transactions will be rounded up for ONLY the debit cards enrolled for ROUND UP. ROUND UP savings will cease if your debit card is replaced, including if you get a different debit card number. The new debit card will need to be enrolled.

I made several purchases yesterday, but I am not seeing the rounded up amount for my ROUND UP savings transfer.

Debit card transactions are rounded up and counted toward the transfer once they post and clear the account (transactions in pending status are not). Signature (credit, point of sale) transactions usually take one or two days to post and settle. Not all vendors process same day transactions, so round up transactions may vary based on timing of vendor processing. Once the debit card transactions post, the ROUND UP savings round up amount will be processed the following business day if funds are available.

Can my round up amount be deposited into multiple savings accounts?

No. The rounded up amount can only be deposited into one Interstate Credit Union savings account as designated by the checking account owner.

Can the round up amount be deposited into an account that is not mine?

No. The rounded up amount can only be deposited into an Interstate Credit Union savings account associated with the member’s number.

If I cancel today, will the transactions from yesterday still post?

If you decide to terminate your daily transfer today, any pending transactions may still be processed as ROUND UP transactions.

What types of debit card transactions qualify for ROUND UP savings?

Both signature-based and PIN-based point of sale debit card transactions qualify for the ROUND UP savings program.

I received a new Interstate Credit Union debit card for the checking account used for ROUND UP savings. Will this affect my enrollment?

Yes. Changing debit cards will interrupt the ROUND UP savings program for the checking account. The new debit card will need to be enrolled.

I had to open a new checking account to replace my account currently being used for ROUND UP savings. Will this affect my enrollment?

Yes, the new checking account will need to be enrolled in ROUND UP savings.

Are there any excluded debit card transactions?

ATM transactions will not be rounded up.

What happens if I close the accounts that are tied to ROUND UP savings?

If the checking account enrolled in ROUND UP savings is closed or all accounts receiving ROUND UP savings transfers are closed, ROUND UP savings will be cancelled.

How do I cancel ROUND UP savings if I change my mind?

You may cancel ROUND UP savings at any time. You can cancel enrollment by stopping by a branch or contacting us during normal business hours. Once ROUND UP savings is canceled, the round-up feature will be removed, and debit card transactions will post for the exact amount as the transaction.